Investing

Key Takeaways

Rising investor fear that inflation will ‘surge’ higher

‘High voltage’, prolonged inflation not our base case

Power of equities under varying inflation ‘currents’

Yesterday was National Battery Day, and if the catastrophic winter storm that caused power outages across the state of Texas didn’t already give us a renewed appreciation for electricity, the critical need for batteries in the distribution process for vaccines surely has. Whether it be for the forklifts in the warehouses, the ground transportation at airports, or the refrigerated trucks and mobile storage units, the use of batteries is paramount when it comes to providing protection against the COVID-19 virus. And it is this exact, gradual process of the US achieving herd immunity that we believe will ‘recharge’ the services sector and truly ‘turn the switch’ on for the US economic rebound. But as the macroeconomic backdrop improves, worries that inflation will ‘surge’ higher will be fueled. The expression “knowledge is power” often holds true when it comes to investment strategy, so we offer our insights on how to position your portfolio in light of our inflation and interest rate expectations in the months ahead.

Not Expecting The Inflation Fuse To Blow | Investors have started to price in an uptick in future inflation, as breakeven inflation rates have gradually moved to multi-year highs. While there are multiple dynamics pushing inflation higher—such as record money supply growth, widening fiscal deficits, supply-chain bottlenecks and surging commodity prices—it is essential to note that this is a welcomed development. The reason: it is a sign the economy is healing from the pandemic that drove prices lower during the intense days of the COVID-crisis in March and April. More important, these price increases will likely prove transitory in the near term as we do not foresee a sustainable move above 2% for core inflation for a prolonged period of time. Given that the economy remains ~2.5% below pre-pandemic levels, wage pressures remain muted with the US labor market well below full-employment, and rent prices (a significant component of core inflation) contained, there is limited ‘conductivity’ for a long lasting surge in inflation. This is consistent with the ‘powers that be’ at the Federal Reserve (Fed), as the January FOMC Minutes reiterated that the economy remains “far from the Committee’s longer-term goals” and that it will look beyond any transitory increases in inflation above its stated goal of 2%. As a result, we expect the Fed to leave its current accommodative monetary policy stance for the foreseeable future and do not expect it to implement an interest rate hike until 2023 at the earliest.

Performance Grid Under Varying Inflation Currents | Despite the equity market being near record highs, we remain optimistic long term as this current bull market is only ~one month away from celebrating its first anniversary (good news: the average bull market lasts ~6 years). Positive factors include accommodative fiscal and monetary policy that are likely to lead to the best year of economic growth since 2000 (~4.0% GDP growth forecasted for 2021) and the best earnings growth (27%) since 2009. Will inflation short circuit this rally? The short answer is no and, in fact, it may help the rally. When analyzing how the S&P 500 performed under varying levels of core inflation, equities performed above-average in an environment where core inflation was between 1-4%. These levels of inflation are generally considered ‘healthy’ when they coincide with improving economic activity. The reason: companies that have pricing power can lift their prices while simultaneously benefitting from productivity efficiencies which helps boost earnings growth. In contrast, during more economically challenging periods such as deflation or hyperinflation (core inflation >5%), commodities outperform equities. Given our expectation for core inflation to be ~2%, we analyzed the performance of the S&P 500 sectors when core inflation was in the range of 1-3%. Since 1990, the average performance relative to the S&P 500 on a year-over-year basis has been strongest for the Technology, Health Care, and Consumer Discretionary sectors (outperformance of 6.8%, 2.3%, and 2.0%, respectively)—all of which are our preferred sectors.

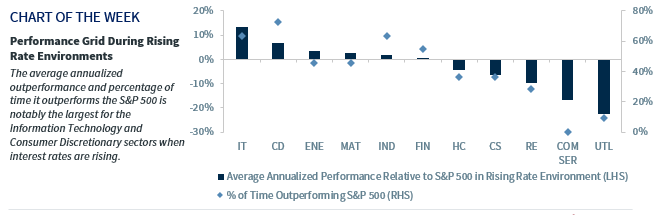

Possibility Of Amped Up Interest Rates | With interest rates rising for the right reasons—improving economic growth and a ‘healthy’ rise in inflation—the 10-year Treasury yield has climbed to the highest level since last February. Sector performance is sensitive to a rise in yields. With our view that the the 10-year Treasury yield will rise to 1.50% by year end 2021 (from the current 1.30% level), several of our preferred sectors should benefit. Since 1990, during rising rate environments, the more cyclical sectors have outperformed. The average annualized outperformance relative to the S&P 500 and the percentage of time it outperforms the S&P 500 is largest for the Tech, Consumer Discretionary and Industrials sectors—three of our preferred sectors. Higher dividend yielding sectors like Utilities, Real Estate and Consumer Staples tend to underperform.

All expressions of opinion reflect the judgment of Raymond James & Associates, Inc., and are subject to change. Information has been obtained from sources considered reliable, but we do not guarantee that the material presented is accurate or that it provides a complete description of the securities, markets or developments mentioned. There is no assurance any of the trends mentioned will continue or that any of the forecasts mentioned will occur. Economic and market conditions are subject to change. Investing involves risk including the possible loss of capital. International investing involves additional risks such as currency fluctuations, differing financial accounting standards, and possible political and economic instability. These risks are greater in emerging markets. Companies engaged in business related to a specific sector are subject to fierce competition and their products and services may be subject to rapid obsolescence. Past performance may not be indicative of future results.