Investing

Key Takeaways

Economy has benefitted from the fruits of the fed’s labor

Tech-oriented sectors the ‘work horses’ of the rally

‘Working the angles’ of the fixed income market

Happy Labor Day! In the past, we’d simply wish everyone a final summer weekend of rest and relaxation with family and friends, but this year, we are especially thinking of our nation’s first responders, health care professionals, and essential workers for whom most of the year has been all work and no play. Of course, it is also hard not to think of those who lost their job as a result of the COVID-19 pandemic, and we hope that all will be able to regain employment as the economy improves. The outbreak rattled both the economy and financial markets, and it was quickly revealed that certain parts of the economy, sectors, and industries would recover more quickly than others. The S&P 500 closing at new record highs earlier this week is indicative of investor optimism, but underneath the surface it is important to analyze what is and what is not ‘working’ for both the US economic recovery and the various financial markets with an eye on what will ‘work’ in the future.

The US Economy | The US economic recovery was bound to begin once states started to reopen, but the progress made thus far has undoubtedly benefitted from the fruits of the Federal Reserve’s labor. From accommodative monetary policy (e.g., zero interest rates, flexible inflation target) to ongoing debt purchases, the Fed has not ceased its efforts to ensure that the economy rebounds from its worst decline in history. However, from a fiscal stimulus perspective, we hope Congress will labor away until a Phase 4 stimulus deal is reached. Having already failed to beat the clock in order to prevent supportive policies such as the additional unemployment benefit from expiring, policymakers need to put partisan differences aside and work ‘overtime’ to provide individuals, businesses, and states with much needed aid in order to propel the economic recovery further.

Bottom Line | The US economy has its work cut out for it to fully recover from the COVID-19 induced recession. While it will take some time before GDP returns to pre-pandemic levels (not likely until 2022), many hands will make light work as our real-time activity metrics continue to rebound off severely depressed levels. In the months ahead, ongoing Fed intervention, a fiscal stimulus package, adherence to social distancing guidelines, and a gradual return to work for the 14 million Americans who are unemployed should help the economy regain momentum pending a second-wave outbreak does not occur. We have expressed concern that if the initial vaccines do not work like a charm (possible low 40-60% efficacy rate), the return to normality may be delayed; but further medical advancements in therapeutics should help consumer sentiment and support the recovery.

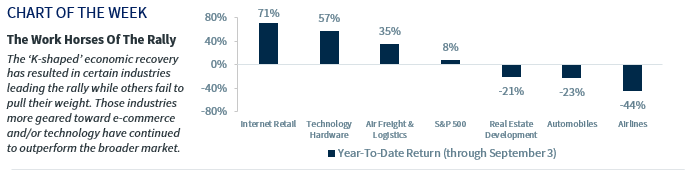

The Equity Market | The S&P 500 has rallied a staggering 55.7% from the March 23 low, notching nine new record highs since the pandemic began, and likely to post its best summer (Memorial Day to Labor Day) since 1938! However, the rally has not occurred without vast levels of dispersion, with certain sectors and industries doing most of the ‘leg work.’ From a sector perspective, Technology, Consumer Discretionary, and Communication Services remain the top three performing sectors year-to-date— outpacing the broader S&P 500 index by 23%, 18%, and 8%, respectively. At the industry level, internet retail (71%), technology hardware (57%), and air freight and logistics (35%) have been the ‘work horses’, while real estate management and development (-21%), automobiles (-23%), and the airlines (-44%) have struggled to ‘pull their weight.’

Bottom Line | In the midst of the lockdowns, we expressed our expectation for a ‘K-shaped’ economic recovery, in which certain industries would benefit (e.g., e-commerce, medical supplies), some would bounce back quickly due to pent-up demand (e.g., technology, home improvement), some would face a slow, prolonged recovery due to psychological barriers and new proto calls (e.g., airlines, restaurants), and some would face troubled recoveries (e.g., luxury-oriented retailers, real estate). In aggregate, as anticipated, this has been realized and these underlying trends will likely not reverse until a reliable, widely available vaccine is produced. For this reason, we continue to emphasize the importance of asset allocation and selectivity, encouraging investors to structure their portfolios in a way that works all of the angles of this economic recovery.

The Fixed Income Market | The bond market has experienced its fair share of dispersion too. While the Barclays Aggregate Bond Index is only up 2.1% this summer, high yield and emerging market bonds have rallied 8.8% and 7.6% respectively, with high yield on pace for its second best summer on record. Of course, due to the Fed’s ongoing corporate debt purchases, investment-grade bonds have outperformed too, up 5.6% over the course of the summer and up nearly 20% since spreads spiked in mid-March.

Bottom Line | For fixed income investors, buying the sectors the Fed is buying (munis and investment grade) has worked thus far and should continue. As the recovery grows, decreased risk asset volatility should lead corporate spreads to narrow even further. However, we caution chasing the recent outperformance of high-yield bonds, as we believe exposure to areas like Energy and retailers may see a spike in default rates over the next 12 months that will negatively impact their performance.

All expressions of opinion reflect the judgment of Raymond James & Associates, Inc., and are subject to change. Information has been obtained from sources considered reliable, but we do not guarantee that the material presented is accurate or that it provides a complete description of the securities, markets or developments mentioned. There is no assurance any of the trends mentioned will continue or that any of the forecasts mentioned will occur. Economic and market conditions are subject to change. Investing involves risk including the possible loss of capital. International investing involves additional risks such as currency fluctuations, differing financial accounting standards, and possible political and economic instability. These risks are greater in emerging markets. Companies engaged in business related to a specific sector are subject to fierce competition and their products and services may be subject to rapid obsolescence. Past performance may not be indicative of future results.