Investing

By Larry Adam, Chief Investment Officer RJF, Friday 13 December 2019

Key Takeaways

Fed Decision ‘Lands Smoothly’ in Financial Markets

Impeachment Proceedings Will Likely Be ‘Stranded’ in Senate

Headline Risk Will Continue to Cause ‘Market Turbulence’

The Transportation Security Administration screened a record-breaking number of travelers during the Thanksgiving holiday, as more than 26 million passengers and crew members passed through checkpoints nationwide. The lyric “there’s no place like home for the holidays” must be true. With travelers and airports preparing for what will likely be another record setting month as the holiday season continues, we wanted to provide you with a ‘first class’ ticket to our latest thoughts on the Fed, trade, impeachment, and market volatility. Safe travels to you and your families!

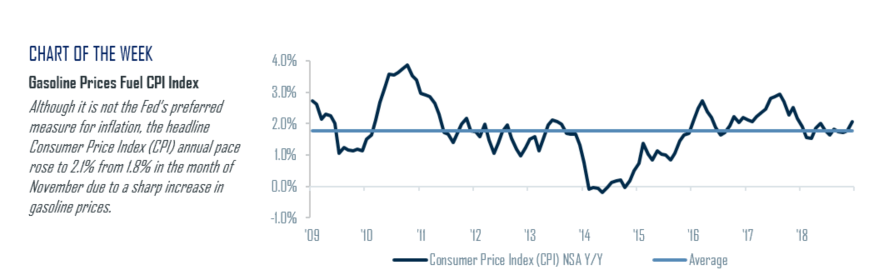

Fed Decision Makes a Smooth Landing | The Federal Reserve’s (Fed) unanimous decision this week to leave rates unchanged ‘landed’ smoothly in financial markets. Unlike previous FOMC meetings, there were no expectations for a fourth rate cut given the overall positive economic data released over the past few months and the apparent de-escalation in US/China trade tensions. In his press conference, Chair Powell highlighted the resiliency of the labor market, with the unemployment rate and jobless claims passing expectations and targets with ‘flying’ colors. The one area of concern that he has consistently acknowledged is muted inflation. The Fed’s preferred measure for inflation, the personal consumption expenditures (PCE) index, has remained well below the 2.0% target. However, the headline consumer price index (CPI) rose 0.3% in the month of November, with the annual pace rising to 2.1% from 1.8%. This rise was largely driven by the energy component, as gasoline prices were up 1.1% last month. Sharp price increases across specific components such as fuel prices have served as a headwind for certain industries, including transports. But Chair Powell’s comments (and the Fed members ‘dot plot’ which showed rates on hold throughout all of 2020) for future rate hikes were clear: until there is significant, persistent inflation at the broader level, interest rates will not be raised. We similarly forecast that Fed policy changes will be ‘grounded’ in 2020.

Phase One Trade Deal is on the Runway While USMCA Takes Flight | The US and China agreed to a preliminary deal, with key issues such as US agricultural purchases and a phased rollback of tariffs seemingly discussed. While the phase one deal pulled away from the ‘tarmac,’ we need confirmation of the details before we consider this deal truly ‘cleared for departure.’ The USMCA trade deal is prepared for take-off, as members from both parties agreed on modifications related to labor enforcement, digital commerce, and patent protections for prescription drugs. While the agreement must still be ratified, it was a constructive compromise between both US political parties and between the US and two of its major trading partners. The deal could serve as a positive catalyst as the US and China address the ‘bigger baggage’ in the next round of trade talks.

House Members Carry On Impeachment Process | The impeachment proceedings completed the ‘next leg’ of the trip this week, with two articles of impeachment brought against President Donald Trump on the grounds of abuse of power and obstruction of Congress. In what will likely be a quick vote by the House Judiciary Committee, the articles will pass to the full House, which given the 37 seat majority for the Democratic Party, should garner a swift approval. While these stages and their accompanying headlines may induce volatility in the near term, the articles of impeachment will likely be left ‘stranded’ in the Republican-controlled Senate. A two-thirds majority is required for a conviction, which would require 20 Republican senators to vote in favor of Trump’s removal. The markets currently echo our sentiments, with a 92% probability that the House will pass at least one of the articles, but only a 14% probability that the Senate will convict Trump.

Fasten Your Seatbelt for Market Turbulence | The Volatility Index (VIX) had remained below 15.0 for 36 days and was nearing the lowest levels since 2017 until last Monday, when President Trump suggested that a US/China trade deal may not occur until after the 2020 election. While still low from a historical perspective, and especially compared to last December’s 35.0+ level, it has remained elevated heading into the highly anticipated December 15 tariff date. In addition, there had been a sense of complacency within the market, as long positions on the VIX reached new record lows. As we move into next year, we expect volatility to ‘ascend’ from and not ‘descend’ to those historically low levels. Several catalyst for volatility-inducing headlines include elevated expectations, impeachment, the US presidential election, and a ‘revisiting’ of trade tensions. Just like airline seats, modest pullback periods will feel uncomfortable, but we view them as normal, healthy tests for equities and would use them as buying opportunities.

All expressions of opinion reflect the judgment of Raymond James & Associates, Inc., and are subject to change. Information has been obtained from sources considered reliable, but we do not guarantee that the material presented is accurate or that it provides a complete description of the securities, markets or developments mentioned. There is no assurance any of the trends mentioned will continue or that any of the forecasts mentioned will occur. Economic and market conditions are subject to change. Investing involves risk including the possible loss of capital. International investing involves additional risks such as currency fluctuations, differing financial accounting standards, and possible political and economic instability. These risks are greater in emerging markets. Companies engaged in business related to a specific sector are subject to fierce competition and their products and services may be subject to rapid obsolescence. Past performance may not be indicative of future results.