ISQ - April 2021

Key Takeaways

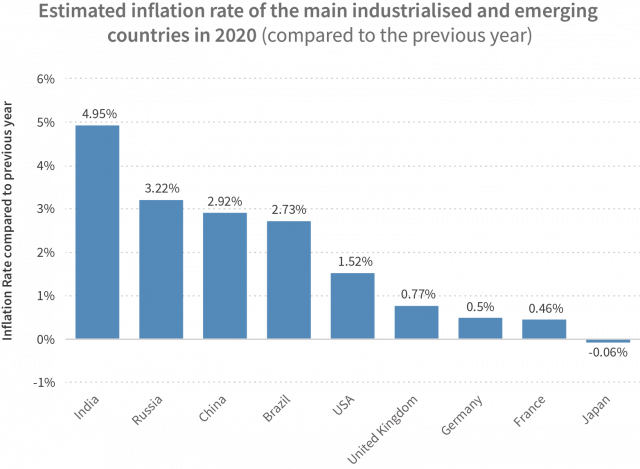

As a result of a slow emergence from lockdown, financial markets have spent much of 2021 obsessing about building inflationary pressures.

Europe’s economic recovery has been postponed again.

Until COVID-19 is completely beaten, international commerce will continue to be impaired.

Yet for all the talk, what do our own eyes reveal to us? The crude oil price is falling back from recent high levels. Barring a temporary blip higher caused by a crashed tanker in the Suez Canal, forcing oil-related traffic to make the more circuitous journey around the African Cape, Brent crude has dropped well below $70 per barrel and the lighter grade, West Texas Intermediate, below $60 per barrel. The International Energy Agency is reporting a steady supply build-up as production exceeds demand. Meanwhile, across developed economies, longer dated government bond yields have dropped back too. The repatriation by Japanese pension and life assurance companies of substantial funds parked in US Treasuries, to “window dress” domestic performance ahead of that country’s fiscal year-end on 31 March, thus driving US Treasury prices lower and yields higher, is now over and “normal service” is resuming.

So, what is going on? On a global level, away from purely the US and the UK, the war against COVID-19 is nowhere near over.

On a global level, away from purely the US and the UK, the war against COVID-19 is nowhere near over.

On Wednesday 24 March the message from Germany really drove that message home. The daily count of new COVID-19 cases in that country is rising rapidly again and, if the current rate is sustained, will double over the next three weeks. The under-pressure Chancellor, Mrs Angela Merkel, has been forced into an abrupt “U-turn” having earlier emerged from a highly fractious 11-hour meeting with regional leaders to announce an ultra-hard five-day lockdown of the entire country over the Easter weekend. With national elections scheduled for the end of September, what the electorate think counts for a lot. Public pressure dissuaded the Chancellor from following through with implementation, although all plans to reopen the German economy remain on hold, at least until the next high-level meeting on 12 April. Add to that the fact that Italy is now locked down completely again and that restrictions have been reimposed in France and the clear conclusion is that Europe’s economic recovery has been postponed again.

Away from Europe the picture is no better. It is worth noting that global daily COVID-19 infection rates are now ahead by 65% from February’s low and higher by the same margin over last spring’s peak. Until COVID-19 is finally vanquished, the world over, there cannot be a lasting economic recovery. Until COVID-19 is completely beaten, international commerce will continue to be impaired.

Until COVID-19 is completely beaten, international commerce will continue to be impaired.

It’s a point often made, but well worth reiterating. The activities most severely impacted by containment policies aimed at curbing the virus’ spread are mainly those in the service sector and amongst lower income earners. This cohort have seen incomes hit hard by the enforced closure of businesses and are effectively living on government hand-outs. In contrast, wealthier people are actually saving money by not commuting to work, not taking overseas holidays and not dining out. People locked down cannot go to the gym, or the spa, to the theatre or to visit a museum. Neither can they take a business trip, stay in a hotel, attend a conference or otherwise run-up the expense account. Demand for many of the services that comprise a big proportion of both household and business budgets is down, sharply down!

This, for the most well-off, leaves savings higher and cash yearning to be spent. So, demand for electronic equipment, household durables and any other consumer items that Amazon can deliver is soaring. Also soaring is demand for bigger houses outside congested urban areas, where isolation and work-from-home is more convivial.

Issued by Raymond James Investment Services Limited (Raymond James). The value of investments, and the income from them, can go down as well as up, and you may not recover the amount of your original investment. Past performance is not a reliable indicator of future results. Where an investment involves exposure to a foreign currency, changes in rates of exchange may cause the value of the investment, and the income from it, to go up or down. The taxation associated with a security depends on the individual’s personal circumstances and may be subject to change.

The information contained in this document is for general consideration only and any opinion or forecast reflects the judgment of the Research Department of Raymond James & Associates, Inc. as at the date of issue and is subject to change without notice. You should not take, or refrain from taking, action based on its content and no part of this document should be relied upon or construed as any form of advice or personal recommendation. The research and analysis in this document have been procured, and may have been acted upon, by Raymond James and connected companies for their own purposes, and the results are being made available to you on this understanding. Neither Raymond James nor any connected company accepts responsibility for any direct or indirect or consequential loss suffered by you or any other person as a result of your acting, or deciding not to act, in reliance upon such research and analysis.

If you are unsure or need clarity upon any of the information covered in this document please contact your wealth manager.

APPROVED FOR CLIENT USE