Key Takeaways

Volatility May Spike As Tax Hikes Are Debated

Political Tensions Will Rise As The Mid-Term Elections Near

A Taper Tantrum May Occur If The Fed Adjusts QE

Today marks 100 days since President Biden was sworn into office, a time often referred to as the ‘honeymoon period’ for a new president’s tenure. It is typically when a new president has the most political capital to tackle his greatest priorities. President Biden assumed the presidency at a critical juncture in our nation’s fight against the COVID-19 pandemic and in the economic recovery process, and his two goals of turning the corner on the virus and achieving broad-based economic prosperity are not mutually exclusive. We will leave the grading of his initial actions toward his campaign promises to the media outlets, and instead evaluate the economic progress and equity market performance seen thus far versus prior presidents, and provide our outlook as to whether the current trajectory of the economy and equity market will shift during this ‘post-honeymoon’ stage we are entering.

A Reflection Upon The First 100 Days | Our nation has been fortunate to ward off the fourth surge in COVID cases through inoculation. In fact, the US has now distributed over 237 million doses of vaccines, well above President Biden’s upwardly revised 200 million target, and appears to be on track for achieving herd immunity by our target date of late July.

Rebounding Growth | The combination of improvements on the vaccination front, the decline in new cases, and the gradual reopening of the economy led to a 6.4% increase in GDP during his first quarter in office—the best opening quarter of growth for an administration since President Reagan’s 8.1% growth rate in 1980.* What has bolstered the economic recovery is the historic level of fiscal stimulus passed. In fact, the recent $1.9 trillion ‘Rescue’ package has sent ~160 million payments worth a total of $384 billion directly into the pockets of consumers, and businesses still under pandemic-related distress have received additional, timely aid. Due to the rebound in growth, and the easing of restrictions, more than 2.2 million jobs will likely be created during Biden’s first three full months in office, more than double the previous record under President Carter.

Equity Bull Run | With this positive economic backdrop, the equity market has rallied, and while history reveals it is not unusual during this ‘honeymoon’ period as the S&P 500 has done so ~70% of the time, this rally has been a standout. In fact, the S&P 500 has rallied ~10% over the last 100 days, the largest rally since President Roosevelt’s 86% in 1933.* More important, the strength has been broad-based, with all 11 S&P 500 sectors in positive territory led by Financials (19.0%).

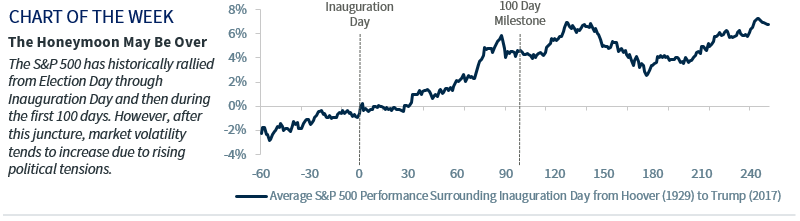

Looking Beyond The First 100 Days | As we look past this 100 day milestone, it is important to focus our attention on what lies ahead. While we expect the economy’s rebound to be robust, leading to the best annual growth rate since 1984, we also expect the equity market will incur an increase in volatility, as it historically does in the ‘post-honeymoon’ period of the inauguration year as policy debates heat up. With our sights on the remainder of the year, we predict at least three drivers of volatility:

A Taxing Situation | The Biden Administration has outlined plans for the $2.25 trillion American Jobs Plan and the $1.8 trillion American Family Plan, and corporate and individual tax increases are the potential ‘pay-fors’ for these stimulus packages. Assuming that no bipartisan agreement is reached and the path of budget reconciliation is taken, the razor thin Democratic majority leads us to believe that the eventual tax increases will not be as large as initially proposed. For example, our belief is that a 25% or lower corporate tax rate (up 4% from 21%) could be absorbed by the market, but anything higher would at least temporarily hamper the market. The magnitude of capital gains and individual tax increases will also remain in focus.

Partisan Politics Won’t Be Put In The Past | As we progress through the summer and fall, political divisions could intensify as both sides of the aisle position for the mid-term elections next year. Biden’s administration will seek to establish a track record of achieving its promised goals, but too little compromise could favor the Republicans as mid-term elections tend to favor the party not in power. Currently, betting markets give the Republicans a 68% probability of winning the House.

A Taper Tantrum If The Fed Adjusts Policy | Despite the steady, consistent stance echoed by the Federal Reserve, the market has anxiously awaited policy direction from Chair Powell. If the acceleration in economic growth is vastly above the Fed’s expectations, it may force earlier than expected tapering of asset purchases. The equity market has traditionally reacted negatively to such a move, and this may be especially true if the adjustments to quantitative easing happen before year end.

The Bottom Line | We remain optimistic on US equities longer term based on strong economic and earnings trends. However, the next few months could be accompanied by the traditional volatility spike as the president’s honeymoon period comes to a close.

All expressions of opinion reflect the judgment of Raymond James & Associates, Inc., and are subject to change. Information has been obtained from sources considered reliable, but we do not guarantee that the material presented is accurate or that it provides a complete description of the securities, markets or developments mentioned. There is no assurance any of the trends mentioned will continue or that any of the forecasts mentioned will occur. Economic and market conditions are subject to change. Investing involves risk including the possible loss of capital. International investing involves additional risks such as currency fluctuations, differing financial accounting standards, and possible political and economic instability. These risks are greater in emerging markets. Companies engaged in business related to a specific sector are subject to fierce competition and their products and services may be subject to rapid obsolescence. Past performance may not be indicative of future results.