ISQ - October 2021

Key Takeaways

Global growth continues to shift away from advanced nations toward emerging markets.

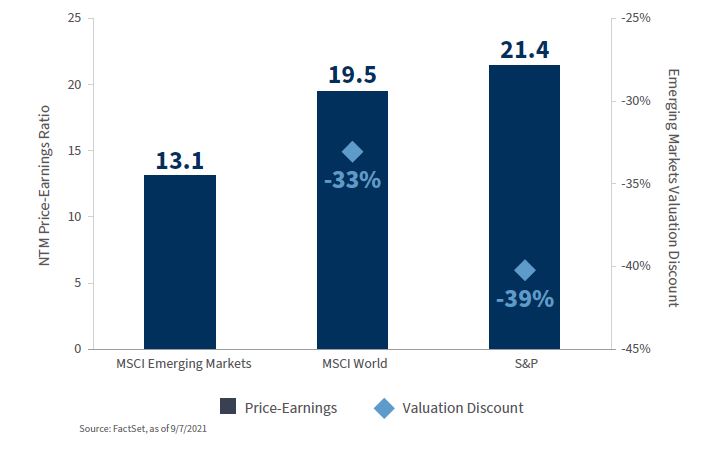

Emerging market equities are nearing their cheapest levels in over 20 years.

The rising middle class should support increasing consumption and underpin growth trends for years to come.

The global economy has recovered strongly from the pandemic, however, growth has been uneven. Advanced

economies have been in the driver’s seat throughout the recovery, as access to vaccines and acceptance rates have

accelerated the reopening process in their respective economies. Emerging markets have faced considerable challenges as the lingering virus and slower than anticipated vaccine rollouts have created headwinds for their recoveries.

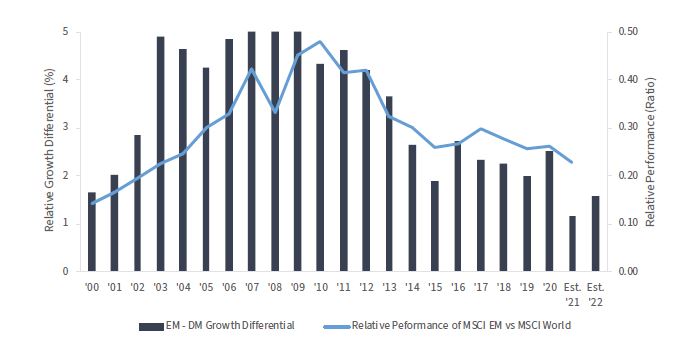

These diverging paths have led to a narrowing in the growth premium between developed and emerging markets and caused the performance of emerging market equities to fall further behind their developed peers. While the recent setback is disappointing, we still believe that emerging markets offer strong long-term potential and diversification benefits in a balanced portfolio. Below, we outline the factors that are shaping our view and some issues to watch in the current macro environment.

We still believe that emerging markets offer strong long-term potential and diversification benefits in a balanced portfolio.

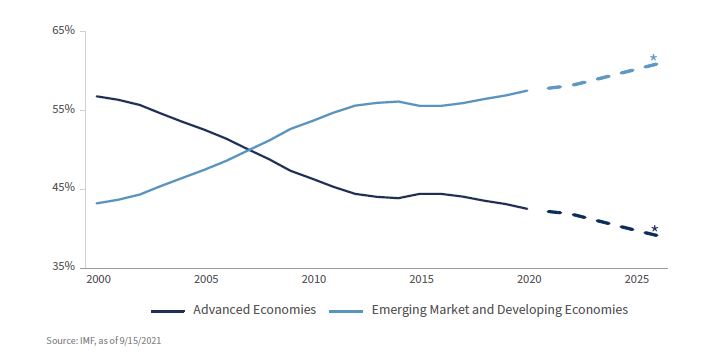

Emerging markets have been a dominate force in the global economy over the last twenty years. In 2001, emerging markets accounted for over 40% of global growth. Today, they represent nearly 58% of the global economy. The International Monetary Fund expects their share to rise to over 60% by 2025 as the urbanization of their economies and growth of the middle class continues. While pandemic-related challenges are temporarily restraining growth relative to developed markets, we do not expect this trend to continue. With vaccination rates improving and tentative signs that COVID cases are stabilizing, the near-term weakness in emerging market growth may not be as soft as the market fears. This should tilt the growth differential back in favour of emerging markets, with another meaningful boost when the impact of the sizeable fiscal and monetary stimulus in developed markets starts to fade.

Emerging markets tend to grow faster than advanced economies, with the relative performance of equity markets closely tied to the directional trends. While emerging markets have lagged, we expect rising vaccination rates and a strong global recovery to turn the growth differential back in their favour.

The International Monetary Fund expects emerging markets to capture an increasingly larger share of global growth on a purchasing-power parity basis in the coming years, making their economic importance hard to ignore.

*Dotted lines represent forecasted numbers

The recent weakness in emerging market equities has widened the valuation gap with developed markets even further from already discounted levels. The underperformance of the asset class has caused the MSCI Emerging Markets Index to trade at a 30-35% discount relative to the MSCI World Index and a 40% discount to the S&P 500 Index. This is significantly below historical averages. While much of the discount is attributable to the valuation premium associated with US stocks, emerging market equities are nearing their cheapest levels in over 20 years. These attractive valuation levels will surely appeal to valuation conscious investors.

The rapid ascent of the middle class has been one of the key drivers behind the explosive growth in emerging markets over the last two decades. While the pandemic may have stalled consumption growth across the globe, we do not believe that the slowdown will turn into a permanent impairment in emerging markets. With the size of the global middle class expected to rise considerably over the next decade, and the bulk of the gains coming from the Asia Pacific region, we believe the slowdown will be short-lived. Once the pandemic-related challenges start to level off, the rising middle class should support increasing consumption and underpin growth trends for years to come.

Over the last decade, emerging markets have transformed from cyclically-oriented, commodity-based markets to high-powered technology leaders. While cyclical factors continue to play a role, the Technology sector has emerged as one of the most important drivers within emerging market growth. While China was at the forefront of this revolution, a growing list of tech-related companies within the emerging market universe are trying to capitalise on the growing markets for e-commerce, mobile banking, artificial intelligence, health care, electric-vehicle batteries and more. We expect these trends to continue as more companies look to meet the needs of their tech-savvy consumers.

While China emerged quickly from the pandemic, lingering virus outbreaks and ongoing supply chain issues have taken a toll on its domestic economy. The slowdown is coming at a time when Beijing’s broadening regulatory crackdowns have also undermined investor confidence in the market, leading to underperformance of Chinese equities over the last six months. It has also weighed on the performance of emerging market equities given China’s heavy weight in the index. While it is impossible to know how long China’s regulatory reforms will continue to weigh on Chinese stock prices, the weakness does not seem to be spilling over into the wider emerging market universe. One of our favoured indicators for flagging risk aversion in emerging markets is the JP Morgan Emerging Market Bond Index spread, which has been remarkably stable through China’s recent rout.

Emerging markets are extremely vulnerable to changes in Federal Reserve (Fed) policy. History has shown that Fed tightening, or even the expectation of future rate increases, can often trigger instability and capital flight away from emerging markets. With the Fed inching toward tapering its asset purchases, emerging markets have been bracing for what could come next. The last time the Fed signalled tapering was on the horizon in 2013, 10-year Treasury yields climbed nearly 1.25% over a four-month period, which caused a 10% decline in emerging market equities. We do not expect a repeat of the 2013 episode, as the Fed has been care-fully preparing the markets so there will not be any surprises that would lead to an unwanted tightening in financial conditions.

There is a strong inverse relationship between the performance of emerging market equities and the US dollar. This means that when the dollar is appreciating relative to foreign currencies, emerging market equities tend to underperform the S&P 500 Index, and vice versa. Emerging markets have remained weak as the Fed’s Broad Trade Weighted Index has been in a structural uptrend since late 2011. While our longer-term view suggests the dollar is overvalued and should weaken relative to its foreign trading partners, pandemic-related uncertainties and the dollar’s role as a safe-haven currency have kept its value elevated on a relative basis.

We continue to believe that emerging markets will remain a powerful driver of global growth and the recent narrowing in its growth premium should be short-lived. The longer-term benefits of investing in economies with superior growth prospects and supportive demographic and consumer trends should lift valuations relative to its developed market peers. While the coming months may bring some additional turbulence, emerging market equities remain cheap. As always, it pays to be selective when investing in emerging markets as the asset class is not a homogeneous group.

Issued by Raymond James Investment Services Limited (Raymond James). The value of investments, and the income from them, can go down as well as up, and you may not recover the amount of your original investment. Past performance is not a reliable indicator of future results. Where an investment involves exposure to a foreign currency, changes in rates of exchange may cause the value of the investment, and the income from it, to go up or down. The taxation associated with a security depends on the individual’s personal circumstances and may be subject to change.

The information contained in this document is for general consideration only and any opinion or forecast reflects the judgment of the Research Department of Raymond James & Associates, Inc. as at the date of issue and is subject to change without notice. You should not take, or refrain from taking, action based on its content and no part of this document should be relied upon or construed as any form of advice or personal recommendation. The research and analysis in this document have been procured, and may have been acted upon, by Raymond James and connected companies for their own purposes, and the results are being made available to you on this understanding. Neither Raymond James nor any connected company accepts responsibility for any direct or indirect or consequential loss suffered by you or any other person as a result of your acting, or deciding not to act, in reliance upon such research and analysis.

If you are unsure or need clarity upon any of the information covered in this document please contact your wealth manager.

APPROVED FOR CLIENT USE