Back to Top ↑

Key Takeaways

Production of containers should resolve shipping costs

Commodity prices are receding from recent peaks

Understanding the cyclical element of inflation

It was just this time last year that shutdowns, cancellations and fears of traveling dominated the headlines and developing a widely available, effective vaccine in record time seemed a long shot at best. Fast forward twelve months, and the US economy is singing a vastly different tune, with optimistic headlines signaling a surprising return to normalcy pervading the airwaves. This robust rebound has rightfully come with some pricing pressures that have struck a chord with investors fearing that the Federal Reserve (Fed) will taper asset purchases ahead of schedule. We do not want to sound like a broken record, but with the inflation fear song on repeat, it is important to highlight some of the dynamics that over time will ease pricing pressures. In short, inflation pressures are likely to be transitory (as the Fed expects), peaking during the third quarter before subsiding by the end of the year.

Crank Up The Volume On Container Production | The simultaneous emergence of consumers from spending hibernation (some with extra cash in their pockets thanks to Congress’ stimulus efforts) and amplified demand for goods has led shipping costs to increase over the last year. In some cases, such as the route from China to Los Angeles, the price has nearly tripled ($4.4 Thousand/FEU versus $1.6 in January 2020). The good news is that shipping companies are taking action. During the final quarter of 2020 and the first quarter of this year, they increased their orders for shipping containers (to fit more on existing ships)—the highest level since at least 1Q15—and placed a record amount of orders for new container ships to be built. While it will admittedly take some time for adjustments to impact operations, the combination of these efforts, in addition to ports becoming more staffed as vaccines are disseminated, should drive down transportation costs in the future.

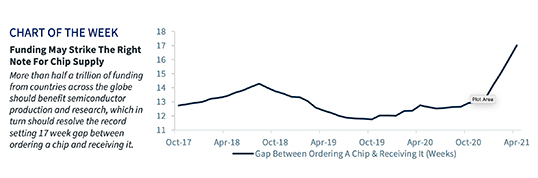

Funding Efforts Should Strike The Right Note For Chip Supply | The limited number of semiconductor chips available for a number of in-demand industries (e.g., consumer electronics, car manufacturing) has been a growing concern for months. However, a quick glance through the headlines demonstrates that companies and politicians will not stand idly by as the delay between ordering and receiving semiconductor chips is at a record high 17 weeks. Within the US, Commerce Secretary Gina Raimondo has proposed $52 billion in funding to boost semiconductor production and research, which could lead to as many as ten new facilities—a critical step for the US since our market share of semiconductor production has decreased to 12% from 37% in 1990. But the US is not alone in its proposed efforts, in fact, additional funding from South Korea, Taiwan, China, and the EU should combine for well over half a trillion dollars, all of which should alleviate future availability concerns.

News Of Falling Input Prices Is Music To The Ears Of Suppliers | Industry specific catalysts led to surging prices for many major commodities such as lumber, steel, and aluminum, but the costs of these commodities are beginning to ease. While all three are still elevated from a historical perspective, they have receded 21%, 17%, and 6% from their respective recent peaks—a hopeful sign that some bottlenecks are easing. If the trend persists, it would take some input price pressures off businesses.

Pandemic Related Demand Coming Down An Octave | The recent inflation statistics are reflective of the base effect, meaning that the prices of today are being compared to the depressed levels of last year. However, there is a cyclical element to inflation as the demand for certain items shifts over time. While Google Searches for home improvement and other ‘lockdown activities’ were at their highest levels a year ago, searches for vacations and flights are at their highest levels in over a year, indicating pent-up consumer travel demand. But this family demand is likely to recede as students go back to in-person school in September.

Bond Market Tuning Out All That Inflation Jazz | As the economy improved and vaccine distribution accelerated, the bond market reacted quickly and strongly to fears that the magnitude of the rebound would lead to a surge in inflation. In fact, the 10-year Treasury yield rose more than 80 basis points from the start of the year to its 1.74% March peak. However since then, the yield has stayed relatively stable, remaining within a 14 basis point range since mid-April. In addition to commentary from Chairman Powell, who continues to stand by the Fed’s expectation for a temporary spike, the bond market appears to be pricing in that elevated inflation pressures may not persist beyond the end of this year.

Bottom Line: Higher Prices Soothe Higher Prices | With sellers naturally inclined to produce more goods at higher prices, businesses are likely to adjust their production to accommodate heightened levels of demand. Already, the semiconductor and shipping industries have begun to respond. These ‘self-correcting’ actions that guide supply to meet demand are supportive of the belief that the recent surge in inflation will be temporary and not limit the growth potential of the US economy.

All expressions of opinion reflect the judgment of Raymond James & Associates, Inc., and are subject to change. Information has been obtained from sources considered reliable, but we do not guarantee that the material presented is accurate or that it provides a complete description of the securities, markets or developments mentioned. There is no assurance any of the trends mentioned will continue or that any of the forecasts mentioned will occur. Economic and market conditions are subject to change. Investing involves risk including the possible loss of capital. International investing involves additional risks such as currency fluctuations, differing financial accounting standards, and possible political and economic instability. These risks are greater in emerging markets. Companies engaged in business related to a specific sector are subject to fierce competition and their products and services may be subject to rapid obsolescence. Past performance may not be indicative of future results.