Back to Top ↑

Investing

Key Takeaways

Important to put index milestones into perspective

Bull markets rarely end in the midst of a strong economy

Shareholder friendly actions should support equity rally

What a difference a year makes! As we enter the second quarter, enthusiasm for a sustainable reopening is mounting whereas last year, economies across the globe were bracing for what would become the height of the virus-induced lockdowns. To address our latest views, please join us for our upcoming Quarterly Coordinates webinar this Monday, April 12 at 4:15 EDT titled Resilience is in Our DNA—And in the Markets. We selected this title as we reflected upon all the changes brought about by the pandemic and the ongoing displays of resilience by the economy, the markets, and each and every one of us. While we hope you can join us on the call, we thought we would address our outlook for US equities as a prelude of what’s to come in light of the S&P 500 crossing the 4,000 milestone for the first time in history. While milestones are important, it is more essential to assess the underlying near term and long-term fundamental factors of the equity market.

Bottom Line–Positive Near and Long Term | The S&P 500 crossed over the 4,000 level for the first time in history last week. What does that really mean? Well, besides being a round momentous number, it represented another all-time record high for the S&P 500—one of many set already this year. It also accentuates how powerful this equity market rally has been from the COVID induced lows last year as the S&P 500 has rallied ~86%—from around 2,200 on March 23, 2020 to the current 4,000+ level.

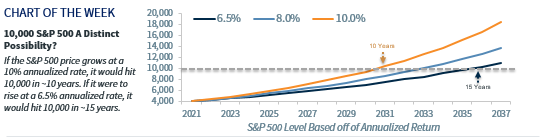

Milestones in Perspective | These big round numbers may be helpful for long-term investors to put the market in perspective. For example, given that it took almost 23 years for the S&P 500 to go from 1,000 (in 1998) to 4,000 (last week), how long do you think it will take for the S&P 500 to reach the monumental 10,000 point milestone?

Answer | What is a surprise to many is the S&P 500 could potentially accomplish this feat in the next 10 to 15 years because of the power of compounding. If the S&P 500 grows its price by 6.5% annually, it will take ~15 years; if it grows ~10% annually, it could take just 10 years. Just for reference, the S&P 500 has grown its price by ~9.2% annually over the last 40 years!

Long-Term Optimistic | Given low interest rates, continued productivity gains, the dynamism of the US economy and a technology revolution still in its early stages, there remain plenty of tailwinds for the equity market. That is why we believe the 4,000 level is just one step in the journey of the S&P 500 reaching the grand level of 10,000 over the next 10 to 15 years.

Near-Term Optimistic | We remain optimistic that the S&P 500 will end 2021 at 4,180. The ABC’s of our thinking include:

Accelerating Economic Growth | With fiscal stimulus greater than expected at the beginning of the year, continued easy monetary policy, and an accelerating reopening of the economy, consensus estimates for GDP have been revised higher from 4.0% to 5.9% since December. Given that bull markets rarely end in the midst of strong economic conditions, the improving health of the economy remains supportive of the upward trajectory of equities.

Balance Sheet Expansion By The Fed | As the adage goes, “Don’t Fight The Fed!” The FOMC minutes confirmed that the Fed will maintain its accommodative stance for the foreseeable future, as the economy still falls short of the committee’s long-term goals of 2% inflation and maximum employment. As such, the continued expansion of the Fed’s balance sheet and its desire to keep interest rates lower for longer should support the equity market’s momentum.

COVID Containment | With nearly 20% of the population fully vaccinated and the daily doses administered rising to over 3+ million per day, the potential of getting to herd immunity by the end of July (our base case) would stave off arguably one of the largest risks to the equity market—the ongoing health crisis.

Dividends & Buybacks Increasing Again | Record cash on firm balance sheets should allow for shareholder friendly actions moving forward. Increased buybacks (share repurchases hit a record high in March), stronger dividend growth (~4% expected in 2021), elevated mergers & acquisitions and strong capex activity should be tailwinds for equities over the next 12 months.

Earnings Growth Rebound | We expect S&P 500 earnings of $190 and $220 in 2021 and 2022 respectively, foreseeing upside to current consensus estimates. The $190 2021 forecast represents ~38% EPS growth—the strongest earnings growth since 2010. The rebound should be broad-based, including many of the industries most impacted by the pandemic.

False Narratives In The Headlines | Contrary to headlines, rising interest rates, healthy levels of inflation, and an eventual Fed rate hike are not necessarily market negatives. In fact, the annualized performance for the S&P 500 has been above average under each of these dynamics as long as economic growth remains robust—which we believe will occur.

All expressions of opinion reflect the judgment of Raymond James & Associates, Inc., and are subject to change. Information has been obtained from sources considered reliable, but we do not guarantee that the material presented is accurate or that it provides a complete description of the securities, markets or developments mentioned. There is no assurance any of the trends mentioned will continue or that any of the forecasts mentioned will occur. Economic and market conditions are subject to change. Investing involves risk including the possible loss of capital. International investing involves additional risks such as currency fluctuations, differing financial accounting standards, and possible political and economic instability. These risks are greater in emerging markets. Companies engaged in business related to a specific sector are subject to fierce competition and their products and services may be subject to rapid obsolescence. Past performance may not be indicative of future results.