Back to Top ↑

Investing

Key Takeaways

Tech sector was the ‘teacher’s pet’ during rally

‘Studying’ the historical impact of corporate tax hikes

Big-Pharma ‘doing their homework’ on vaccine safety

School is back in session! Whether it be virtual or in-person, we hope all students had a safe, terrific first week back in the classroom. We also wish a positive, productive academic year to our teachers, all of whom have gone above and beyond to adjust lessons plans in adherence with COVID-19 related guidelines in an effort to ensure that the next generation of thought leaders receives a quality education during this unprecedented time. Any teacher knows that one of the best ways to keep students engaged is to ask questions, and from my own experience as a graduate professor at Loyola University Maryland I know its not only a way to assess learning but also a way to spark curiosity and conversation. For investors, the S&P 500’s recent 7% pullback, the upcoming presidential election, and the announcement of a pause in a late-stage vaccine clinical trial have all sparked concern, so we’re taking the opportunity to address these very important questions that have come to light this week.

Is This A Repeat Of The Dot Com Bubble? | The S&P 500 posted its best summer since 2009, but lost steam heading into Labor Day Weekend, and as of Tuesday, had declined ~7% in just three trading days. Heading into this pullback, the Technology sector was the market’s ‘teacher’s pet’ as it outpaced the broad S&P 500 by 28%. But just as Tech led the rally, it also declined the most—falling more than 11% over the same three day period. The speed and magnitude of the decline had investors questioning if history would repeat itself, setting up the recent tech-oriented run-up for a painful reversal akin to the Dot Com bubble bursting in 2000. However, there are several factors that differentiate the current state of the Tech sector from the Dot Com Era.

Valuations for the Tech sector are elevated from a historical perspective (NTM 26x vs. 20-year average of 18x), but they are well-below the 2000 peak of 57x and are justifiable given the earnings outlook. The sector is expected to see earnings growth of 5% and 14% in 2020 and 2021 respectively—one of only two sectors expected to see positive earnings growth this year. Lower interest rates should also be supportive, given that today’s 10-year Treasury yield of 0.68% is well below the 6.4% yield in 2000.

Today’s leading tech firms have stronger fundamentals and multiple revenue streams (hardware, software, services, cloud, content, etc.) rather than being one trick ponies focused on a single product or service. Furthermore, the leaders continue to find new applications for existing technologies and invest in future technologies to remain competitive.

In 2000, tech companies were predominately focused on business demand, compared to today where they are at least equally focused on consumer demand as a growth driver. The roll-out of 5G should also serve as a catalyst for both of these markets.

Bottom Line: Info Tech and Communication Services remain two of our favorite sectors, as they are supported by strong fundamentals and long-term growth catalysts even in the aftermath of the COVID-19 outbreak. For these reasons, we’d encourage investors to use pullbacks as potential buying opportunities.

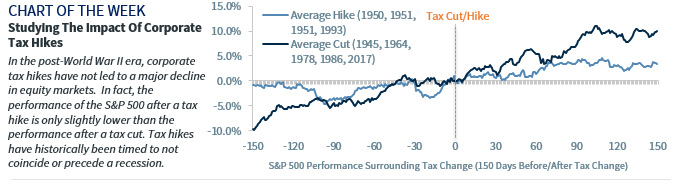

Will Biden’s Corporate Tax Policy Hurt The Equity Market? | With ~50 days to Election Day and former VP Biden maintaining his poll lead, investors have questioned (assuming a Democratic sweep) the equity market impact of Biden’s call for a partial reversal of the 2017 corporate tax cuts (an increase from 21% to 28%). Intuitively, an increase would be a headwind for equities, as it reduces profitability and dampens earnings growth. In fact, our analysis suggests that the proposed higher tax rate, if implemented next year, would cut earnings by ~10%. However, after ‘hitting the books’ and studying the impact of the last four corporate tax hikes in the post-World War II era, we found that the S&P 500 rallied ~8% in the 150 days following the increase and was positive 100% of the time. In addition, none of the tax hikes caused a recession in the year following their implementation.

Bottom Line: Assuming our elected officials have ‘studied’ the health of the economy, we cannot unequivocally hypothesize that higher corporate tax rates will lead to a market decline. Other dynamics such as monetary policy, fiscal policy, the economic recovery, earnings growth and investor sentiment may ultimately dictate the direction of the equity market.

Is AstraZeneca’s Trial Pause An Early Sign Of Trouble For Vaccine Development? | AstraZeneca announced a ‘pause’ in their Phase III clinical trial to investigate a potential adverse reaction. While disappointing, it is important to remember that late stage trials are designed to assess the safety and effectiveness of a vaccine across a large, diverse population. A ‘pause’ is not unusual in trials and there is a reasonable probability that after an independent safety review, the trial will resume in the next week or so.

Bottom Line: This specific vaccine is one of three currently in Phase III trials, but there are over a dozen other potential candidates supported by a record level of research funding that should hopefully result in a successful outcome. Our biotech analyst, Steve Seedhouse**, believes there is an 80% to 90% probability that a limited-use vaccine will become available by year end.

All expressions of opinion reflect the judgment of Raymond James & Associates, Inc., and are subject to change. Information has been obtained from sources considered reliable, but we do not guarantee that the material presented is accurate or that it provides a complete description of the securities, markets or developments mentioned. There is no assurance any of the trends mentioned will continue or that any of the forecasts mentioned will occur. Economic and market conditions are subject to change. Investing involves risk including the possible loss of capital. International investing involves additional risks such as currency fluctuations, differing financial accounting standards, and possible political and economic instability. These risks are greater in emerging markets. Companies engaged in business related to a specific sector are subject to fierce competition and their products and services may be subject to rapid obsolescence. Past performance may not be indicative of future results.