Back to Top ↑

Investing

Key Takeaways

Hopes policymaker action will ‘expedite’ the recovery

Investors view earnings beats as a ‘special delivery’

Not all states successful in ‘handling’ COVID-19

Sunday is the 245th anniversary of the United States Postal Service system. While the motto “neither snow nor rain nor heat nor gloom of night stays these couriers from the swift completion of their appointed rounds’’ has been accurate, add COVID-19 as another challenge that the Postal Service has overcome. Since the virus outbreak began, mail carriers have worked tirelessly to accommodate the ~60% surge in packages as consumers shifted to online shopping while still being able to deliver our mail. They could also find themselves squarely involved in the upcoming election with the likelihood of an increase in mail-in ballots. Similar to mail carriers, our outlook is formulated with a critical look at the ‘route’ ahead to determine what may ‘expedite’ or ‘delay’ our expectations. Deliveries next week include the busiest week of earnings, a Fed meeting, prospects of a fiscal cliff, key economic data, and tentative Congressional hearings. Below is a ‘first class’ view of what to anticipate.

Tracking The Status Of The Economy | The Federal Reserve is scheduled to meet next week, with financial markets awaiting Chair Powell’s commentary on the status of the economic recovery, the potential for additional intervention, and the possible duration of interest rates being held at zero. The Fed’s outlook will be disseminated during a week riddled with economic data, with durable goods orders and consumer confidence released just ahead of the meeting and with the preliminary estimate for 2Q20 GDP (RJ estimate: -30% to -35%—the worst quarter of GDP in the post-WWII era) reported just one day after. After reaching a record $7.2 trillion, the Fed’s balance sheet has started to shrink in recent weeks, but we project this trend will reverse and the balance sheet will grow to ~$8 trillion by year end given that many of the Fed’s established facilities are still underutilized.

Doubts On When A Stimulus Package Will Be Signed, Sealed, & Delivered | With relief deadlines quickly approaching (e.g., additional $600 unemployment benefit on July 31, Payroll Protection Program (PPP) loan applications on August 8), Congress may have to deliver its phase 4 stimulus package in a last-minute ‘overnight’ deal to avoid a substantial drop-off in COVID-19 related relief or negotiations could stretch into August (mild market disappointment). Each party is firm on certain issues (e.g., liability relief for Republicans), but we are optimistic that the needs of households, businesses, and state and local governments will lead to compromise. Ultimately, we anticipate a $1.5 to $2 trillion package that includes an extended unemployment benefit (albeit at a lower level), new parameters for PPP loans and forgiveness, and state aid targeted toward education and health care.

Tech Leaders To Push The Envelope In Congressional Hearing | Although it may be postponed to the week of August 3 in remembrance of Representative John Lewis, the chief executives of Alphabet, Amazon, Apple, and Facebook are tentatively scheduled to testify before Congress next week as the broad-based antitrust investigation of ‘big-tech’ market power continues. Combined, the four companies account for ~$4.8 trillion, equivalent to ~17% of the S&P 500. Each company faces its own unique issues (e.g., data privacy, treatment of facility workers, freedom of speech), but the overarching concerns are excessive market dominance and impermeable barriers to entry for potential competitors. Technology remains one of our top sectors due to the long-term growth catalysts (e.g., anticipated rollout of 5G), but stronger regulatory rhetoric (actual policy a low probability) against tech-oriented companies in an election year could potentially serve as a near-term headwind for the sector.

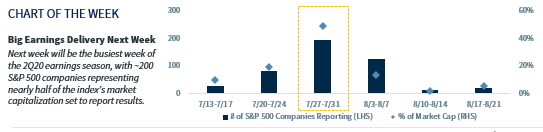

Investors Sorting Through Earnings Results | Next week will be the busiest week of the 2Q20 earnings season, with ~195 S&P 500 companies representing nearly half of the index’s market capitalization set to report results. Only 29% of the market capitalization has reported thus far, but 77% of the companies have beaten earnings per share estimates which is above the previous 20-quarter average of 72%. Due to the prolonged shutdowns, the bar for earnings had been lowered, with estimates for the quarter revised down 48% over the past six months. Therefore, investors have treated companies beating their bottom line estimates as a ‘special delivery,’ with those companies outperforming the broader index by 95 basis points in the day following their announcements. On the other hand, companies that missed earnings expectations have underperformed by ~45 basis points over this same time period. With the economic recovery likely to remain uneven at the company and sector level, better than expected earnings growth and clear, positive forward guidance will be rewarded.

Not All States Earn A Stamp Of Approval | While a substantial number of states are experiencing an uptick in cases, it is only ~8 states that are simultaneously experiencing a rise in the positivity rate, meaning that the rise in cases is not a mere reflection of more testing capabilities. Some hospitals within these states (e.g., FL, ID, LA) have reached full capacity, causing health officials and political leaders to reestablish restrictions and implement mask mandates. If the surge in certain states cannot be contained, statewide lockdowns may become a reality and the speed and magnitude at which the economy will recover will be impacted.

All expressions of opinion reflect the judgment of Raymond James & Associates, Inc., and are subject to change. Information has been obtained from sources considered reliable, but we do not guarantee that the material presented is accurate or that it provides a complete description of the securities, markets or developments mentioned. There is no assurance any of the trends mentioned will continue or that any of the forecasts mentioned will occur. Economic and market conditions are subject to change. Investing involves risk including the possible loss of capital. International investing involves additional risks such as currency fluctuations, differing financial accounting standards, and possible political and economic instability. These risks are greater in emerging markets. Companies engaged in business related to a specific sector are subject to fierce competition and their products and services may be subject to rapid obsolescence. Past performance may not be indicative of future results.