Back to Top ↑

Investing

Key Takeaways

The Fed’s intervention helps ‘buttress’ the bond market

Historic stimulus package ‘builds bridge’ of support

Equity rebound is on ‘the other side’ of the outbreak

Bridges are built to safely transport people over a chasm. In the absence of policymaker action, the US economy was facing a COVID-19-induced chasm. With over 20 states implementing shelter-in-home orders, and even more temporarily closing non-essential business, vast pieces of our economy came to a screeching halt. With economic conditions deteriorating, policymakers responded with speed and precision metaphorically creating bridges to get us to the other side. The US economy will likely struggle temporarily, but the combination of aggressive monetary policy and substantial fiscal stimulus should deter the worst case scenarios from occurring. These efforts will serve as a ‘bridge’ to a place not too far in the future (hopefully June) where the virus is contained, a therapeutic response is developed and the economy returns to normality.

Fed Seeks To ‘Bridge The Gap’ For The US Economy | The Federal Reserve (Fed) has re-implemented programs from crises past and undertaken a series of unprecedented measures to ‘buttress’ economic growth and help credit markets get their ‘bearings.’ After substantial purchases of Treasuries, investment-grade debt, municipal bonds, and mortgage-backed securities over the last several days, the Fed’s balance sheet has reached a record high $5.2 trillion. Although this is below the 2014 peak as a percentage of GDP (24.2% versus 25.3%), Chair Powell’s remarks about the Fed remaining “aggressive” and “forthright” in stabilizing the economy and bond market leads us to believe this record won’t stand for long. This week, we received some of the first economic data points that reflect the negative impact COVID-19 has had on our economy. For example, jobless claims, which had previously trended near 50-year lows, posted a record 3.3 million increase. Unfortunately, this is more than five times the previous historical high of 695,000 set in 1982, and it is no surprise that the virus-impacted sectors such as restaurants, transportation, and entertainment were among the hardest hit. The Fed has acknowledged that controlling the COVID-19 outbreak (through a therapeutic or vaccine) within the US is crucial for the economy to ‘reach greener pastures,’ but it has not and will not cease its tireless efforts to support it with low interest rates in the interim.

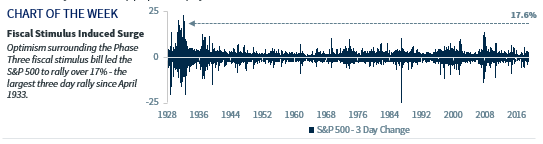

Fiscal Stimulus Is Still ‘Under Construction’ | The Senate, House and the president united in a historically rapid fashion to forge a $2 trillion fiscal stimulus package (Phase 3). While the two previous more targeted phases of stimulus, combining for $108.3 billion, are not ‘water under the bridge,’ it was the announcement of this record-setting bipartisan proposal that led the S&P 500 to rally over 17% in just three trading days – the largest three day rally since 1933! Rightfully so, as this round of stimulus is the broadest in terms of scope and the most substantial in terms of cost. In addition to assistance for larger distressed businesses, knowing relief will be provided outright to American families via direct payments and small businesses via potentially forgivable and interest free loans helped restore hope and provided comfort to the markets. The combination of the three stimulus phases thus far will surpass those of both the Great Depression (1933-1939) and the Great Recession (2008-2009). Similar to the Fed, we do not believe this phase is the last. Since the duration of the outbreak remains unknown, we believe there will be mounting pressure for at least a Phase 4, if not more. Items that could potentially be addressed include more consumer debt relief (possibly with mortgages), infrastructure, and additional hospital and logistical support.

A Rebound For Equities Is Not A ‘Bridge Too Far’ | In times of volatility, equity investors need to have a long-term investment horizon accompanied by a disciplined investment strategy as markets are prone to overreact to both the downside and upside when headlines drive both fear and over-optimism. This ‘Black Swan’ COVID-19 event has led to historic levels of volatility, but we continue to recommend investors remain calm and not panic. The rapid decline of ~34% was investors attempting to assess the potential downside risk to the US economy, earnings growth and equity prices assuming worst case scenarios. However, emotionally-driven selling at the recent lows would have resulted in missing one of the most powerful three day rallies on record once aggressive policy decisions were announced. Instead of trying to time market bottoms or allowing headlines to drive portfolio decisions, allow discipline to be the ‘bridge’ between your investment goals and investment horizon. While headlines will continue to induce near-term volatility, we remain unwavering in our expectation that equities will move higher in the next 12 to 24 months. The possibility of the US outbreak “turning the corner” between Memorial Day and July 4th remains the likely outcome, and if it proves prescient, an economic rebound in the latter half of the year should help propel the equity market.

All expressions of opinion reflect the judgment of Raymond James & Associates, Inc., and are subject to change. Information has been obtained from sources considered reliable, but we do not guarantee that the material presented is accurate or that it provides a complete description of the securities, markets or developments mentioned. There is no assurance any of the trends mentioned will continue or that any of the forecasts mentioned will occur. Economic and market conditions are subject to change. Investing involves risk including the possible loss of capital. International investing involves additional risks such as currency fluctuations, differing financial accounting standards, and possible political and economic instability. These risks are greater in emerging markets. Companies engaged in business related to a specific sector are subject to fierce competition and their products and services may be subject to rapid obsolescence. Past performance may not be indicative of future results.