Back to Top ↑

Investing

By Larry Adam, Chief Investment Officer RJF, Friday 24 January 2020

Key Takeaways

Our recession alarm bells are not currently ‘ringing’

The call for impeachment will likely be ‘blocked’

The cyclical sectors we have on ‘speed dial’

“Do you hear me now? Good.” We can’t help but wonder if these were the words said by Alexander Graham Bell as he called his assistant Thomas Watson to complete the first transcontinental telephone call 105 years ago. The call from New York City to San Francisco (~2,500 miles) was a major technological milestone, as it allowed governments and businesses to communicate instantaneously across substantial distances for the first time. However, it is worth mentioning that this newly discovered ability was quite expensive, with a 3-minute coast-to-coast call costing $20.70, the equivalent of ~$520 (or about half the cost of a new iPhone) today! It also took another 12 years before the next major advancement, the transatlantic call, was successfully completed. Both of these facts are hard to imagine in today’s world, where we can contact anyone, anywhere, at anytime using mobile devices that are incessantly improved upon. We are grateful for all of these telecommunication innovations as they have allowed our views and thoughts on the economy and financial markets to be ‘heard from near and far!’ The anniversary of this specific, significant communication breakthrough provides a very timely backdrop for articulating our views this week.

Economic Data Drops Us A Line | The record ‘long distance’ of the current economic expansion has notably been supported by a healthy labor market, steady consumer spending, and a rebound in global growth. As we assess whether the US economy has the scope to expand further, it is important to ‘keep in touch’ with economic fundamentals as well as our real-time leading indicators (e.g., trucking conditions, withholding taxes, jobless claims, etc.). While our recession alarm bells are not currently ‘ringing,’ there are a few developments and historical precedents that have the potential to put our positive outlook ‘on hold.’ For example, we continue to monitor the Leading Economic Indicators Index, which declined -0.3% in December, as it typically peaks ~13 months prior to a recession. Given that our current assessment of economic data remains overall positive, we are not ‘calling it quits’ on our expectation of relatively robust US economic growth in 2020 anytime soon.

Wires Crossed In Congress | Our recent Investment Strategy Sentiment Survey revealed political risk as the top concern in the financial markets. As it relates to the looming presidential election, we certainly agree. Although Congressional gridlock remains the likely outcome, a lack of a clear Democratic frontrunner combined with heightened polarization across a number of key issues facing the country will amplify the importance of winning key swing states. However, when it comes to the impeachment trial, we believe the perceived risk is just ‘static.’ As anticipated, the hearing is proceeding across partisan lines with the Republican-controlled Senate ‘calling the shots’ and denying the 11 amendments regarding subpoenas to current and former Trump administration officials proposed by top Democratic leaders. We maintain our view that the two-thirds majority will fail to be reached, and the call for President Trump’s impeachment will be ‘blocked.’

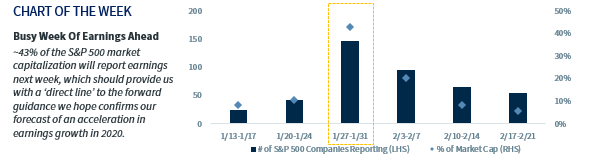

Dialing In On Earnings Expectations | Before the 4Q19 earnings season began, the S&P 500 earnings growth estimates were ‘dialed back’ ~3.8%, which translated to a decline of ~1.5% year-over-over. This week would have marked the start of the busiest two weeks of the season, but due to an unusually high number of delayed reports, it’ll now occur next week when ~43% of the S&P 500 market capitalization will disseminate results for the final quarter of 2019. For this same reason, it is no surprise that consensus forecasts have remained relatively stagnant (-0.03%) since the start of earnings season and that the percentage of companies beating estimates is currently trending below the 20-quarter average (71% versus 73%). But given the fact that ~77% of the market capitalization is yet to report, the final trends and observations from this important earnings season are ‘too close to call.’ The results next week should serve as a ‘direct line’ to the forward guidance we hope confirms our forecast of an acceleration in earnings growth in 2020.

Not Hanging Up On These Cyclical Sectors | From both an earnings and valuation perspective, we have maintained an overweight to more cyclically-oriented sectors such as Information Technology and Communication Services. Our optimism is driven by robust technology-related fixed investment, strong dividend and buyback yields, large cash stockpiles, and of course the debut of 5(G)! The steady adoption of 5(G) across the globe has the potential to be a multi-year catalyst for both of these sectors in particular, so we will be keeping them both on ‘speed dial.’

All expressions of opinion reflect the judgment of Raymond James & Associates, Inc., and are subject to change. Information has been obtained from sources considered reliable, but we do not guarantee that the material presented is accurate or that it provides a complete description of the securities, markets or developments mentioned. There is no assurance any of the trends mentioned will continue or that any of the forecasts mentioned will occur. Economic and market conditions are subject to change. Investing involves risk including the possible loss of capital. International investing involves additional risks such as currency fluctuations, differing financial accounting standards, and possible political and economic instability. These risks are greater in emerging markets. Companies engaged in business related to a specific sector are subject to fierce competition and their products and services may be subject to rapid obsolescence. Past performance may not be indicative of future results.