Back to Top ↑

Investing

By Larry Adam, Chief Investment Officer RJF, Friday 22 November 2019

Key Takeaways

Plentiful Jobs Harvest Should Help Economy Trot On

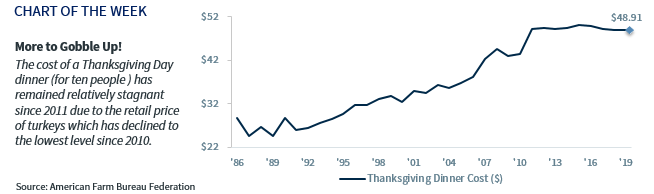

Low Turkey Prices Means More to Gobble Up

All S&P 500 Sectors Part of The Positive Parade

Happy early Turkey Day! We believe in giving thanks throughout the year, but Thanksgiving is the perfect time to reflect on all we are grateful for and investors have a cornucopia of blessings to count! Between the ongoing economic expansion and the S&P 500 up 26.0% year-to-date (YTD), we have quite a long list. Below are our top ten:

#1: US Economic Expansion Continues to Trot | December will mark the 126th month of economic expansion. This record run is due in part to resilient personal consumption, which posted its 39th consecutive quarter of growth in 3Q19. We do not think the US consumer will go ‘cold turkey’ anytime soon, as the National Retail Federation expects retail sales during November and December will rise ~4% from 2018 levels. This leads us to believe that the US economy will continue its slow but steady foot race.

#2: Feast of Fed Rate Cuts | Investors were hungry for rate cuts and the Federal Reserve delivered, providing three 25 basis point ‘insurance’ cuts in light of slowing global economic momentum and trade tensions. We have likened the Fed’s actions to the previous insurance rate cut policies it implemented (1984, 1987, 1995 and 1998), when a 75 basis point cut has historically been a positive for the equity market, leading to a 12-month average forward return of ~23%.

#3: Plentiful Jobs Harvest | The labor market remains healthy, with the three-month average of job gains (~175,000) remaining in line with the ten-year historical average and continuing to support the near 50-year low unemployment rate of 3.6%. These reports, combined with 3.0% wage growth year-over-year, reaffirm our overall positive economic outlook.

#4: US & China Come to the Trade Table| The announcement of the intended signing of a phase one trade deal by Presidents Trump and Xi led the equity market to notch new record highs. Even though the specific parameters of the deal (i.e., scale of tariff relief and timing) are still being discussed, the perception that both sides are motivated to put some differences aside has reduced the level of uncertainty in the markets. We do not want to seem greedy, but a cancellation of the December consumer-oriented tariffs is definitely at the top of our ‘wish list’ this holiday season!

#5: Low Rates the Right Stuff(ing) | Global central bank easing led to a sharp decline in sovereign yields which resulted in ‘bountiful’ returns for bonds. The US Aggregate Bond Index is having its best start to a year since 1995, and the investment grade and high-yield sectors are up ~14% and ~12%, respectively! Housing data indicates that lower rates have aided the housing market too, with housing starts up 8.5% year-over-year and building permits reaching their highest level since 2007.

#6: Low Inflation Means More to Gobble Up | The American Farm Bureau Federation released their annual report for the cost ($48.91) of a Thanksgiving Day dinner for ten people (plus leftovers of course!) and it is only one penny more than last year. The price for the centerpiece of the dinner, the turkey, has declined to $1.30 per pound which is the lowest since 2010.

#7: Low Oil Prices the Gravy on Top | Oil prices remain within the key $55-70 level, which is supportive for both consumer spending and energy-related fixed capital investment. With oil currently at the lower end of this range, it is more in favor of consumers which means it should provide extra cash in their pockets for the upcoming holiday shopping season.

#8: Seasonality Sweet as Apple Pie | Since 1990, the S&P 500 has historically seen the strongest performance in the month of November, averaging a ~1.5% return and being positive over 70% of the time. The market is up 2.3% so far this month, well above this average. Seasonal trends should continue to be supportive of the equity market, since over this same timeframe, the S&P 500 has posted an average return of 8.0% from November to April and has been positive over 85% of the time!

#9: All Sectors Part of the Parade | All eleven S&P 500 sectors are ‘floating’ higher YTD and have been led by technology, which is up over 40% YTD. This is the first time that all sectors have been positive YTD since 2013, and only the fourth occurrence over the last 15 years. This year is also the strongest in magnitude, with the sectors up over 23% on average.

#10: Friends & Family | Last, but certainly not least, we are thankful for our family and friends! We wish you and your loved ones a very Happy Thanksgiving, and as you sit down to enjoy your turkey, tofurkey, or our personal favorite a turporkin (we always advocate for diversification), we hope you have many reasons to be thankful this year and all the years to come!

All expressions of opinion reflect the judgment of Raymond James & Associates, Inc., and are subject to change. Information has been obtained from sources considered reliable, but we do not guarantee that the material presented is accurate or that it provides a complete description of the securities, markets or developments mentioned. There is no assurance any of the trends mentioned will continue or that any of the forecasts mentioned will occur. Economic and market conditions are subject to change. Investing involves risk including the possible loss of capital. International investing involves additional risks such as currency fluctuations, differing financial accounting standards, and possible political and economic instability. These risks are greater in emerging markets. Companies engaged in business related to a specific sector are subject to fierce competition and their products and services may be subject to rapid obsolescence. Past performance may not be indicative of future results.