Back to Top ↑

Key Takeaways

Expecting fourth quarter of +20% earnings growth

Investors will take note of companies that miss estimates

CEO commentary will provide critical insights for 2022

This Monday would’ve been Muhammed Ali’s 80th birthday! The Champ is regarded as one of the iconic athletes of the 20th century given his status as a three-time world heavyweight boxing champion and Olympic gold medalist. But his nickname ‘The Greatest’ may just have to be shared with the earnings results we witnessed throughout 2021, as record earnings growth, earnings beats, and net margins drove the S&P 500 to all-time highs. As we enter the fourth round (4Q21), we expect this quarter to be a heavy hitting season that solidifies our expectation for another above-consensus earnings growth year in 2022. With Big Banks starting to report today, we’re reflecting on the expectations for the season and anticipating CEO commentary that could shed light on whether or not 2022 will follow in 2021’s footsteps.

2021 Earnings Will Pack A Punch | Annual earnings estimates are typically revised down ~5%, on average, from the start of the year to the end. In fact, they were lowered in 15 of the last 22 years! But 2021 has been a huge exception, with earnings per share being revised up ~23% year-to-date. With our 2022 above-consensus S&P 500 earnings estimate of $235, the upward trend in revisions should continue to defy the odds. Key factors to monitor that could influence the path to this year’s earnings include:

Earnings Growth Will Not Throw In The Towel | The S&P 500 should notch its fourth consecutive quarter of 20%+ EPS growth for the first time since 3Q10 (post Great Financial Crisis) and for the second time since 2002. While decelerating for the second straight quarter from its recent peak of ~92% in 2Q21, earnings growth should remain elevated at ~22%. However, this is likely the last quarter of easy comparisons as the earnings environment transitions to a more normal environment for 2022.

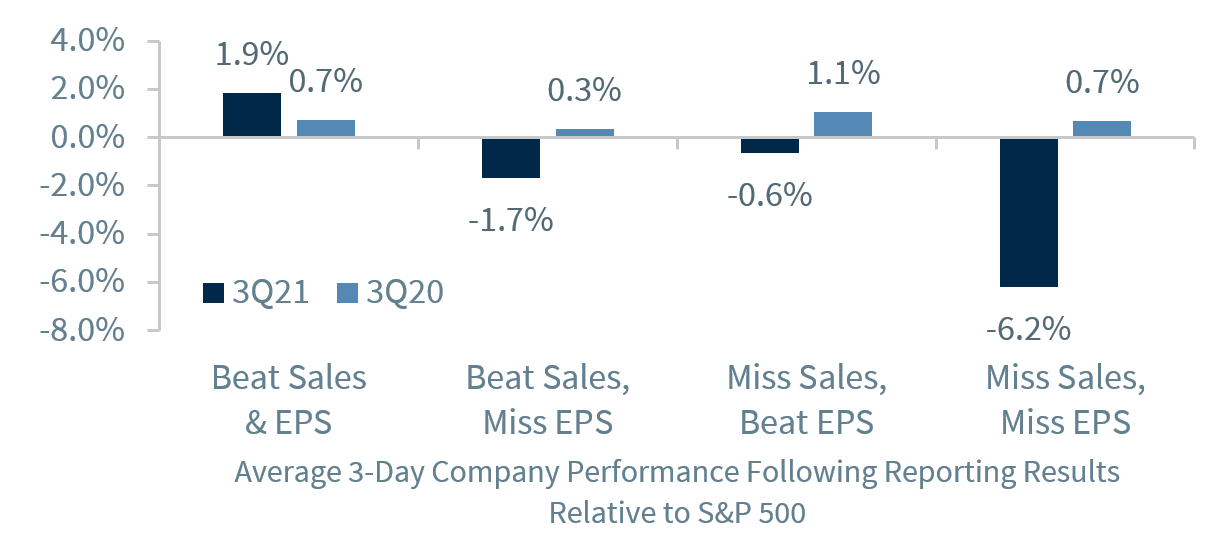

Beats Won’t Fall Below The Belt | The earnings tailwind on performance is undeniable. Since 2Q20, the S&P 500 has been up ~5%, on average, and positive 100% of the time during reporting seasons (season lasts seven weeks). This strength has been driven by companies far exceeding EPS estimates, beating by ~18%, on average, and by more than 10% for the last six quarters for the first time on record. The magnitude of beats will likely moderate this quarter to below 10%, but remain above the long-term historical average of ~5%. A better-than-expected earnings season would help corporate fundamentals overshadow the macro headwinds (e.g., inflation, Fed tightening, COVID) and help the equity market regain its positive momentum after a choppy start to the year. More important, as we saw during the 3Q21 earnings season, investors will be more discerning assessing the winners and losers. Companies that miss on either revenues or earnings will be penalized more from a stock price reaction than companies are rewarded for beating on both the top and bottom line.

Sales Will Still Come Out Swinging | With 2021 nominal GDP expected to be just under 10%, it should be no surprise that revenue growth is forecasted to remain strong at ~13% YoY this quarter—nearly 3 times the 10-year average of 4.5%.

Margins Not Down For The Count Just Yet | Margins are expected to compress from the recent peak (12.2 versus 13.9 in 2Q21), but remain elevated in a historical context. This slight decline will be driven by the Financials, Consumer Discretionary, and Real Estate sectors; but Technology margins, the sector with the highest overall margins at ~25%, should remain resilient.

Forward Guidance Gives Us A Ringside Seat | Earnings results are a scorecard of the trailing quarter, but the accompanying CEO guidance should give critical insights into what is to come in the new year. Here are a few topics to monitor:

Omicron May Put Services Demand On The Ropes | The recent surge in cases has led to a modest downturn in mobility metrics, leading most COVID-sensitive areas (hotels, cruise lines, restaurants, airlines, etc.) to experience downward EPS revisions. With consumer fundamentals remaining healthy, insights from CEOs on the magnitude and longevity of the recent Omicron surge on demand (particularly to services sectors) will be important.

Companies Will Try To Bob And Weave Inflation’s Blows | Evidenced by CPI rising at the fastest pace in 40 years in December, rising input prices, supply chain disruptions and elevated wages have led to significant cost pressures. How businesses are mitigating these pressures and whether or not they can pass on higher prices will be the focus for margins.

Balance Sheets Have Companies On The Front Foot | S&P 500 companies still have record cash on their balance sheets, and we anticipate further capital expenditures, dividend increases, and share buybacks. With capex plans in Regional Fed surveys near cyclical highs, dividends growing at 8% YOY, and share buybacks at record levels, a continuation of these trends will be a tailwind for the equity market.

All expressions of opinion reflect the judgment of Raymond James & Associates, Inc., and are subject to change. Information has been obtained from sources considered reliable, but we do not guarantee that the material presented is accurate or that it provides a complete description of the securities, markets or developments mentioned. There is no assurance any of the trends mentioned will continue or that any of the forecasts mentioned will occur. Economic and market conditions are subject to change. Investing involves risk including the possible loss of capital. International investing involves additional risks such as currency fluctuations, differing financial accounting standards, and possible political and economic instability. These risks are greater in emerging markets. Companies engaged in business related to a specific sector are subject to fierce competition and their products and services may be subject to rapid obsolescence. Past performance may not be indicative of future results.