Back to Top ↑

Key Takeaways

Consumer fundamentals near or at pre-COVID peaks

Macroeconomic backdrop should bolster earnings growth

Historically low volatility unlikely to continue in 2022

The opening ceremony for the Winter Olympics is just four weeks away, but the athletes have spent years training to ultimately experience either the thrill of victory or the agony of defeat. As we anxiously prepare to watch, we felt the Olympics scored a 10 as a backdrop for our Ten Themes for 2022, which we will present via a webinar this Monday, January 10 at 4:15 EST. Our Ten Themes presentation is a collection of what we deem to be the most critical economic and financial market insights for investors in the upcoming year, and each will be tied to one of the captivating winter sports. As a sneak peak of what to expect, we’ll use ski jump, biathlon, curling, and snowboarding metaphors to articulate this year’s views for the US economy, the equity market, market volatility, and Technology sector, respectively.

US Economy No Longer Needs Stimulus To Lift Off | The combination of accommodative fiscal and monetary policies helped the US economy gain significant momentum, but we foresee it achieving above-trend growth without these supportive actions in the year ahead (2022 GDP Forecast: ~3.5%). Indeed, it may mark the first time since 1999-2000 that the economy meets or exceeds this threshold in back-to-back years. Despite the impending fiscal cliff, other components of GDP are expected to be strong, particularly personal consumption—which is critical since it accounts for ~70% of growth. Spending has been resilient since the start of the recovery, but with all consumer fundamentals (e.g., labor market confidence, wage growth, household spending plans, and cash balances) at or near pre-COVID peaks it should remain robust throughout this year. We’re also hopeful that this third year of the pandemic could be the charm, with mitigation measures, vaccines, therapeutics, and garnered immunity helping the US reach the endemic stage of the virus. Consumers returning to normal activities, combined with continued capital expenditures and gradual inventory rebuilding, should all be tailwinds for growth in the year ahead.

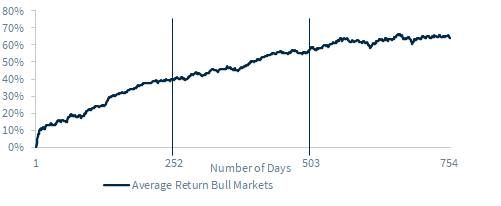

Adjusting Our Aim For The Third Year Of The Bull Market | It’s impossible to ignore the power of this current bull market, which has by far registered the strongest start to a bull market on record. However, the returns in the third year of a bull market are historically more muted in comparison to those for the first and second, and the Federal Reserve (Fed) beginning a tightening cycle and the midterm elections have typically caused some seasonal challenges as well. However, the expected above-trend economic growth should be supportive of earnings growth and equities moving higher. In fact, the average annual return for the S&P 500 has been ~12% when GDP is in our expected range (2-4%), and the index is positive ~80% of the time. If this macroeconomic backdrop bolsters our above-consensus forecast for 14% earnings per share growth, the S&P 500 could easily reach the 5,050 milestone. While valuations may seem lofty, they are attractive on a relative basis in the midst of this still low interest rate environment. We continue to favor the cyclical sectors, but emphasize the importance of selectivity and identifying key long-term growth catalysts for each (e.g., e-commerce presence for Consumer Discretionary companies).

Headlines Will Sweep In Causing Friction In The Markets | Between the best year of economic growth since 1984, the equity market’s rally amid record earnings, healthy commodity gains, and low interest rates, 2021 will be tough to beat! Add in the fact that the S&P 500 only saw one 5%+ pullback compared to its usual three to four and the lowest intra-year decline since 1995, and there was not much for investors to balk at. Unfortunately, we don’t foresee this low level of volatility continuing over the next 12 months. Whether it be the onset of the Fed’s tightening cycle, midterm elections, COVID-related impacts, or geopolitical risk, there will be no shortage of volatility-inducing events. For this reason, active management and selectivity will be critical.

No Bindings On Technological Re-Invention & Adoption | If there’s a problem, technology is here to solve it. At least its felt that way for decades now! Technology has had to reinvent itself to continue its incessant revolution and contributions to productivity. Whether it be providing a communication platform regardless of distance or language barriers in the metaverse, automated processes to address labor shortages, 3D printed food to lessen the environmental impact, or delivery at the speed of light—the innovations of this digital age seem limitless. While valuations for tech-oriented firms are elevated, they are justified by the continued strength in earnings and the fact that business plans for future tech spending are at record highs.

For a more in-depth discussion of our Ten Themes for 2022 and insights from our Quarterly Investment Strategy Sentiment Survey, please register for Monday’s webinar using this link stay tuned to my Twitter account @LarryAdamRJ for the replay.

All expressions of opinion reflect the judgment of Raymond James & Associates, Inc., and are subject to change. Information has been obtained from sources considered reliable, but we do not guarantee that the material presented is accurate or that it provides a complete description of the securities, markets or developments mentioned. There is no assurance any of the trends mentioned will continue or that any of the forecasts mentioned will occur. Economic and market conditions are subject to change. Investing involves risk including the possible loss of capital. International investing involves additional risks such as currency fluctuations, differing financial accounting standards, and possible political and economic instability. These risks are greater in emerging markets. Companies engaged in business related to a specific sector are subject to fierce competition and their products and services may be subject to rapid obsolescence. Past performance may not be indicative of future results.